This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

STOCK TRADING SERVICE

Our chat rooms will provide you with an opportunity to learn how to trade stocks, options, and futures. You’ll see how other members are doing it, share charts, share ideas and gain knowledge.

Our traders support each other with knowledge and feedback. People come here to learn, hang out, practice, trade stocks, and more. Our trade rooms are a great place to get live group mentoring and training.

TRADE ALERTS “SIGNALS”

The Bullish Bears trade alerts include both day trade and swing trade alert signals. These are stocks that we post daily in our Discord for our community members.

These alert signals go along with our stock watch lists. Our watch lists and alert signals are great for your trading education and learning experience.

We want you to see what we see and begin to spot trade setups yourself.

REAL-TIME STOCK ALERTS SERVICE

We also offer real-time stock alerts for those that want to follow our options trades. You have the option to trade stocks instead of going the options trading route if you wish.

Our stock alerts are simple to follow and easy to implement. We post entries and exits.

Also, we provide you with free options courses that teach you how to implement our trades as well.

STOCK TRAINING DOESN’T NEED TO BE HARD

Stock training doesn’t need to be hard. But it sure feels hard when you don’t know where to turn for legitimate knowledge. There are tons of places to learn, but what makes us different?

Well, for starters, we’re just real everyday people who like trade stocks. We’re not gurus portraying a fancy lifestyle of cars and jets and beaches. Can you obtain those things with what we teach you? Sure you can. Is that what motivates us when teaching you how to trade?

Nope. What we really care about is helping you, and seeing you succeed as a trader. We want the everyday person to get the kind of training in the stock market we would have wanted when we started out.

WHY WE’RE DIFFERENT

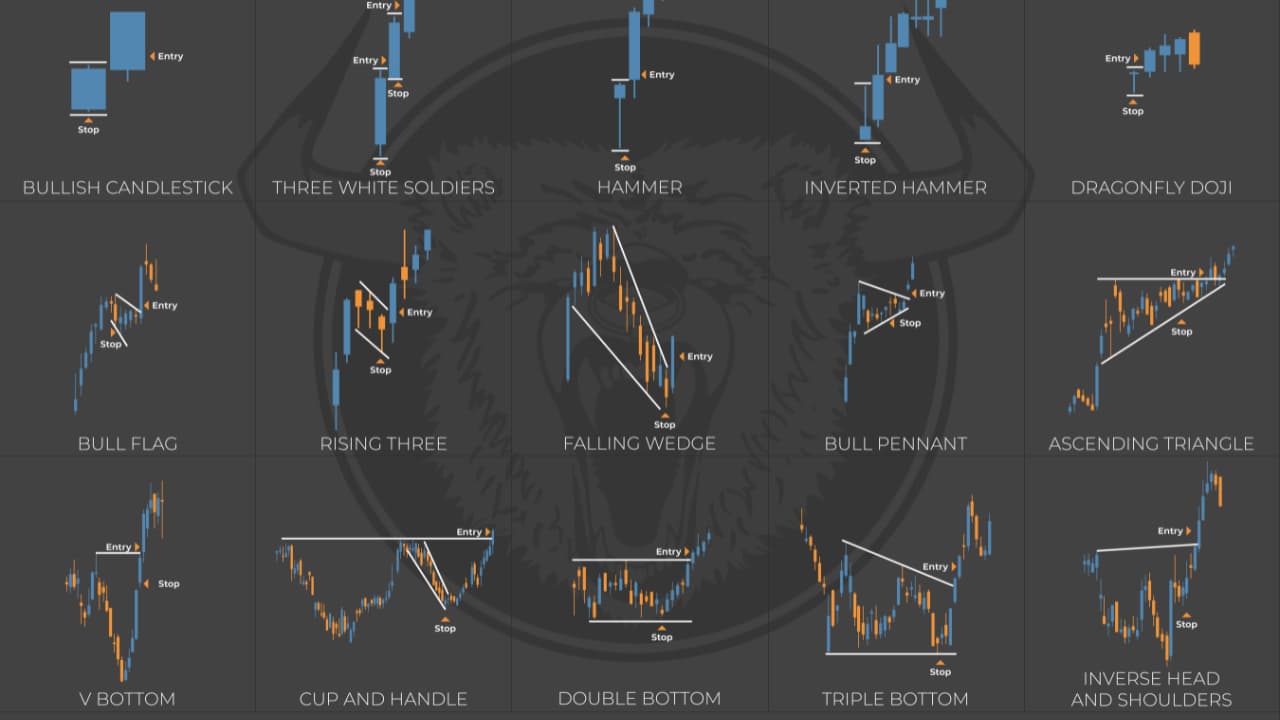

What else makes us different? When it comes to the stock market, we’ve won, we’ve lost, we’ve lived, and learned. We’ve been through the ups and downs in the market and figured out what really matters. The Charts…Candlesticks = PRICE ACTION! We’ve created a site that passes all this knowledge on to you.

We don’t charge you an arm and a leg for the stock training we give you. We charge a modest amount that goes towards running our day-to-day operations and paying for our invaluable team moderators that are passionate about teaching YOU!

That’s about it. We could charge more, but we have a pay it forward, give back mentality. It’s not about the money. The best and most important thing for us is YOU. We want to feel good about what we do, and the results and reviews speak for themselves.

Those emails we get, the feedback, the success we see. That is what our educational trading community is all about. We hold no secrets back. Our trading edge is your trading edge.

STOCK TRAINING DONE RIGHT

We don’t care what your motivation is to get training in the stock market. If it’s money and wealth for material things, money to travel and build memories, or paying for your child’s education, it’s all good. We know that you’ll walk away from a stronger, more confident, and street-wise trader.

In our stock trading community, you’re going to get it all. Futures, options trading, and stocks. Not just penny stocks either. Small, mid, and large caps. Each day we have several live streamers showing you the ropes, and talking the community though the action.

There’s no catch, no smoke or mirrors. What you see is what you get. If you’re looking to change your life, or someone else’s, we’re here to help you reach that goal. Get started learning day trading, swing trading, options, or futures trading today!

Click Here to start your 7-day free trial.